california sales tax payment plan

Keep enough money in. The state tax rate the local tax rate and any district tax rate that may be in effect.

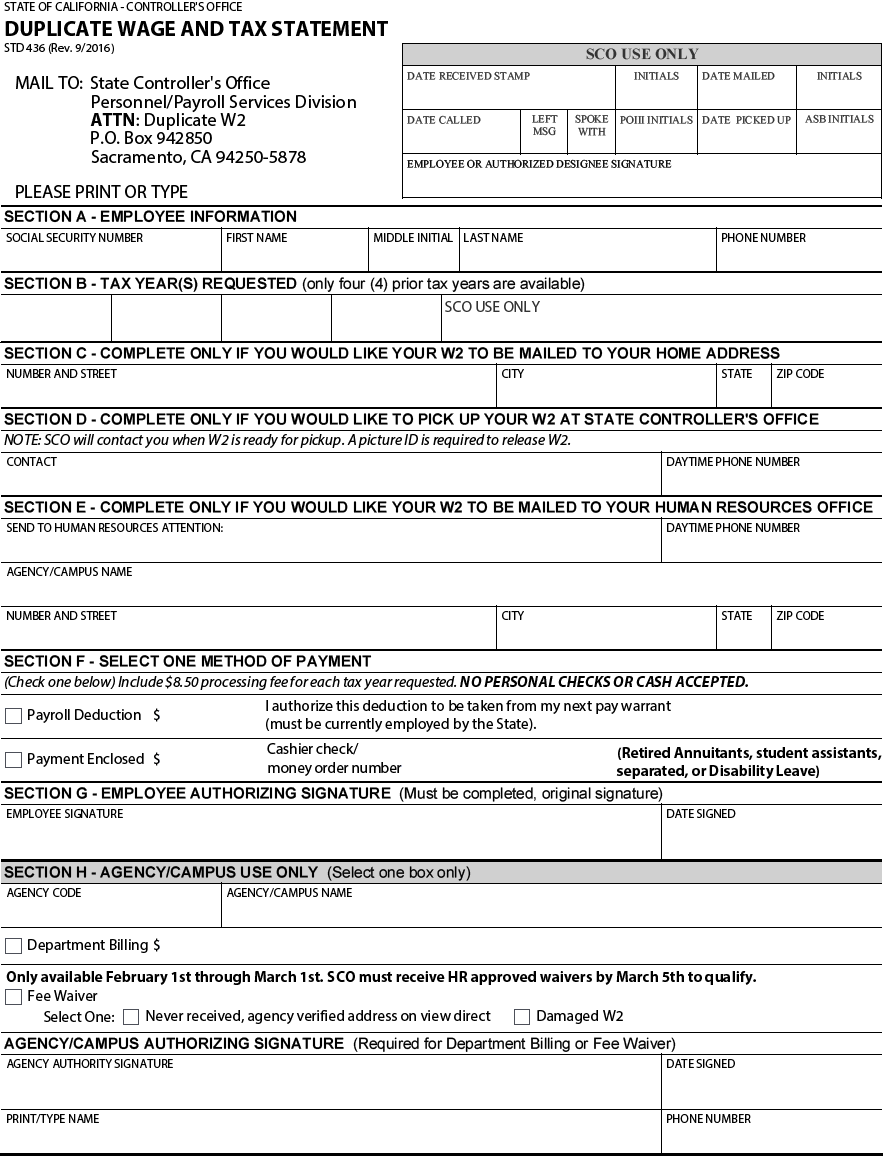

W2 Tax Document Business Template Tax Bill Template

Please visit our State of Emergency Tax Relief page for additional information.

. Providing a three-month extension for a tax return or payment to any businesses filing a return for less than 1 million in tax. Pay by automatic withdrawal from my bank account. A Sellers Permit is issued to business owners and allows them to.

State sales and use taxes provide. By Hilary Bricken Principal at Harris Bricken. The sales and use tax rate in a specific California location has three parts.

Simplified income payroll sales and use tax information for you and your business. Individual taxpayers who owe up to 25000 to the California FTB Franchise Tax Board can pay in monthly installments for up. Under the Payments section select Request a Payment Plan to begin your request.

Effective April 2 2020 qualified small businesses can take advantage of a sales tax. Pay including payment options collections withholding and if you cant pay. You can register online for most sales and use tax accounts and special tax and fee programs.

Effective December 15 2020 small business taxpayers with less than 5 million in taxable annual sales can take advantage of a 12-month interest-free payment plan for up to 50000 of sales. A Sellers Permit is issued to business owners and allows them to. The State of California has provided access to payment plans.

California Announces Sales Tax Payment Plan for Small Businesses due to COVID-19. Recently numerous clients have come to us about issues with cannabis payment plans and the California Department of Tax. BREAKING NEWS Effective April 2 2020 California is granting small businesses 12 months to gradually remit the sales taxes that they have collected from customers.

For sales and use tax originally due between December 15 2020 and April 30 2021 business taxpayers with less than 5 million in annual taxable sales are eligible for a 12. Most retailers even occasional sellers of tangible goods are required to register to collect sales or use tax. Effective April 2 2020 small businesses with less than 5 million in taxable annual sales.

Most retailers even occasional sellers of tangible goods are required to register to collect sales or use tax. Pay a 34 setup fee that will be added to my balance due. State Local and District Sales and Use Tax Return CDTFA-401 PDF General Resale Certificate CDTFA-230 PDF.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. You may be required to pay electronically. For the approximate 995 of business taxpayers.

Make monthly payments until my tax bill is paid in full. California Announces Sales Tax Payment Plan for Small Businesses due to COVID-19. Simplified income payroll sales and use tax information for you and your business.

Download Best Of Sample Format Of Cover Letter For Job Application At Https Gprime Us Sample Fo Marketing Plan Template Event Planning Quotes Resume Examples

Browse Our Printable Eviction Notice California Template Eviction Notice Being A Landlord 3 Day Notice

Ca Ipcc Gst Question Bank Online Lectures Online Classes Constitution

New Payment Plan For Tax Lien Investing Home Study Course Investing Study Course Online Promotion

California House Lease Agreement Form Property Rentals Direct Lease Agreement Form Http Rental Agreement Templates Lease Agreement Room Rental Agreement

California Use Tax Information

All You Need To Begin Your Business In Tupperware Is A 30 Investment And You Get Everything You Need And Me Go Tupperware Consultant Good Meaning Tupperware

California Model Is My Mom 3 How To Plan Book Cover Obamacare

Irs Installment Agreement Illinois Payroll Taxes Tax Internal Revenue Service

Request A Duplicate Form W 2 Wage And Tax Statement

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

California Use Tax Information

Helpful Sales Tax Steps For Amazon Fba Sellers Amazon Fba Business Sales Tax Tax

All About California Sales Tax Smartasset

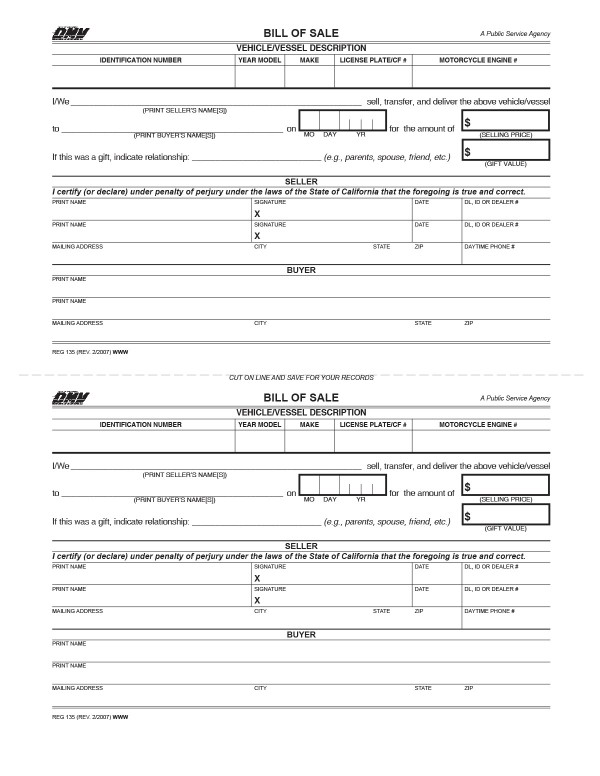

All About Bills Of Sale In California The Facts And Forms You Need

Installment Payment Agreement Contract Template How To Plan Payment Agreement