greenville county property tax estimator

Please call the assessors office in Greenville before you send documents or if you need to schedule a meeting. Get driving directions to this office Greenville County Assessors Office Services.

South Carolina Property Tax Calculator Smartasset

The unequal appraisal process is utilized to expose opportunities for tax savings even if.

. When contacting Greenville County about your property taxes make sure that you are contacting the correct office. This calculator is designed to estimate the county vehicle property tax for your vehicle. Please Note The Tax Estimator DOES NOT include DMV fees.

The median property tax on a 14810000 house is 97746 in Greenville County. If you have general questions you can call the Town of. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Internet payments received after closing time will be counted as being made the next day. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Richland County - Personal Vehicle Tax Estimator.

Please note that we can only estimate your property tax based on median property taxes in your area. You can call the Greenville County Tax Assessors Office for assistance at 864-467-7300. Greenwood County Tax Estimator South Carolina SC.

005 - HORSE CREEK DUNKLIN FIRE 007 - SPEC ABATE CORRECTION COLL 008 - SPEC ABATE CORRECTION REF 015 - POSSUM KINGDOM S GVL FIRE 025 - COLUMBIA ANDERSON SCH-DUNKLIN 026 - POSSUM. 864 467 7300 Phone 864 467 7440 Fax The Greenville County Tax Assessors Office is located in Greenville South Carolina. There are typically multiple rates in a given area because your state county local schools and emergency responders each receive funding partly through these taxes.

Homestead Less School Operations. County of Greenville Tax Collector Suite 700 301 University Ridge Greenville SC 29601. The Tax Estimator should be considered only as an estimate.

Estimate Property Tax Our Greenville County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in South Carolina and across the entire United States. Your payment is considered received as of the Post Mark date. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100.

Greenville County Real Property Services 301 University Ridge Suite 1000 Greenville South Carolina 29601 Contact Info. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100. Say three similar homes sold for 500000 while the re-evaluated property requires new shingles costing 10000 then its estimated value drops to 490000.

The Tax Estimator is designed to provide an estimated range on property tax for a Vehicle Camper or Watercraft in Greenville County. The largest tax in. The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value.

866-549-1010 Bureau Code 8488220. Please Enter Only NumbersTax District. Please Enter Only Numbers.

Find Greenville County Property Tax Info From 2021. SC assesses taxes at a 4 rate for owner-occupied homes and at a 6 rate for other properties. Pay by Phone for Property Tax.

If paying by mail please make your check payable to Greenville County Tax Collector and mail to. The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. Tax Year 2022 Estimated Range of Property Tax Fees 0.

What this means is that if the marketappraisal value of your property is 180000 the assessed value is 7200 if you live in the home as your primary residence and 10800 if you use the property as a rental or vacation home or something else. Please Enter Only Numbers. Estimate NOT applicable on split ratio properties.

County functions supported by GIS include real estate tax assessment law enforcementcrime analysis economic development voter registration planning and land development. This is a TAX ESTIMATE only. DMV Registration fees are charged every 2 years.

005 - HORSE CREEK DUNKLIN FIRE 007 - SPEC ABATE CORRECTION COLL 008 - SPEC ABATE CORRECTION REF 015 - POSSUM KINGDOM S GVL FIRE 025 - COLUMBIA ANDERSON SCH-DUNKLIN 026 - POSSUM. School Tax Credit Savings. School 4 days ago Calculate.

Real Property Tax Estimator - Greenville County. Often your questions can be answered quickly via email. Ultimate Greenville Real Property Tax Guide for 2022.

For comparison the median home value in. No title work after 345 pm in the Motor Vehicle Department. Whether you are already a resident or just considering moving to Greenville to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Greenville County collects on average 066 of a propertys assessed fair market value as property tax. Our mission is to provide accurate and timely geographic information system access technical assistance and related services to meet the needs of County operations. Remember to have your propertys Tax ID.

You can call the Town of Greenville Tax Assessors Office for assistance at 207-695-2421.

Ultimate Guide To Understanding South Carolina Property Taxes

Entities Detail Proposed Property Tax Rates Local News Heraldbanner Com

Why Land Values Are Rising In Greenville County South Carolina

Congratulations To Sccja Class 650 Tri County Fop Lodge 3 Congratulations Class

Toll Brothers At Liseter The Merion Collection Pa Luxury Homes Delaware Homes For Sale Home Builders

Physiographic Regions Of Alabama Teaching Social Studies Map Skills Social Science

Pin On Beautiful Homes In New Jersey

New York Property Tax Calculator 2020 Empire Center For Public Policy

Physiographic Regions Of Alabama Teaching Social Studies Map Skills Social Science

South Carolina Property Tax Calculator Smartasset

Woodlands At St Georges By Toll Brothers In Bear Delaware Luxury Homes Delaware Homes For Sale Home Builders

Pickens Sc Homes For Sale And Real Estate In Pickens Sc Realtortlowe Yeahthatgreenville Move To Greenville Keller Williams Gr Real Estate Estates Lake Keowee

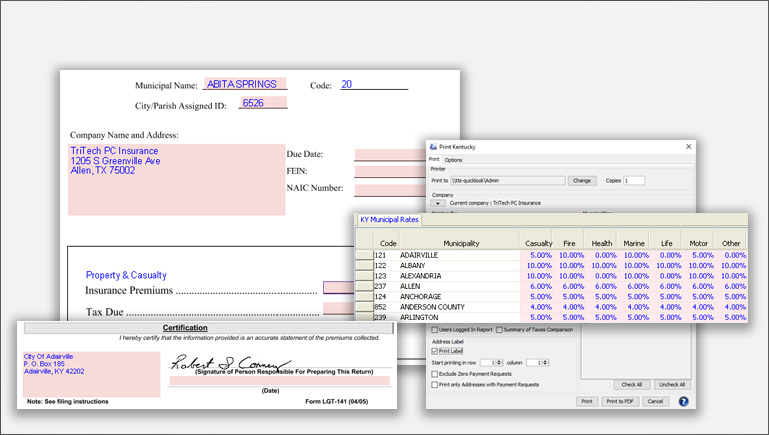

Municipal Tax Tritech Software

South Carolina Property Tax Calculator Smartasset

Elkton At High Oaks Estates Luxury New Homes In Walpole Ma Delaware Homes For Sale Dream Home Design Luxury Homes

Tax Rates Hunt Tax Official Site

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy